Many businesses utilize the accrual basis of accounting rather than cash accounting, and for good reason. It’s considered a best practice, providing a better overall picture of a company’s financial well-being.

But how easy is it to focus on the details of that picture?

The recent AP Control Panel, conducted in partnership between Hyland and the Institute of Finance and Management (IOFM), queried accounts payable professionals about how easily they’re able to use invoice data in order to:

- Track and report accruals

- Predict payments

Since AP handles most of the organization’s cash, it should be in an excellent position to report on both of these things. But is that the reality?

How much insight does AP really have?

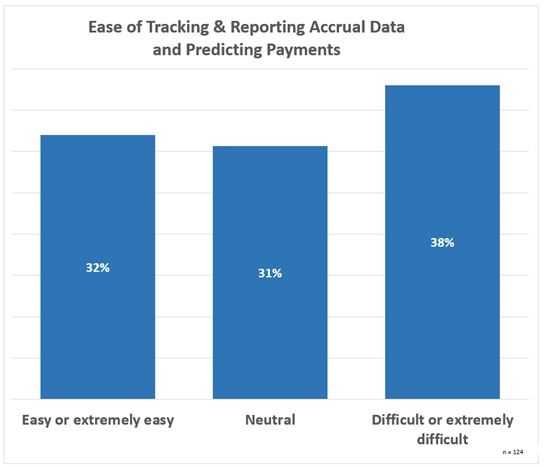

We asked survey respondents to rate their organizations on how well they can report on these two key issues.

Here are the aggregated results:

While participants were almost evenly divided between finding it easy or neutral to obtain this important information, the majority of them found it difficult.

Yet organizations depend on AP to provide this critical data.

What part does automation play?

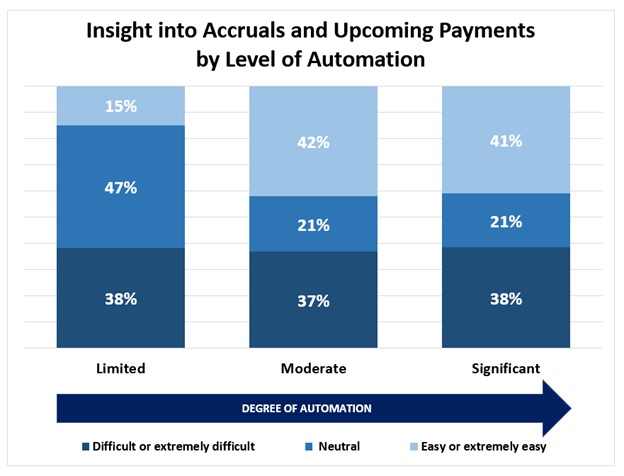

While it might be logical to assume that those with more automation would find this process easier, is that actually the case? We also asked respondents to report on their level of automation — whether high, moderate, or low — to see if there’s a correlation.

Here are the results:

Predictably, those with limited automation tended to have more difficulty gathering this important working capital data from their AP automation systems. However, somewhat surprisingly, those with moderate and significant automation fared about equally in terms of transparency into working capital metrics.

It seems reasonable to conclude that at some point, there’s a diminishing return of business intelligence, where more automation doesn’t necessarily correlate to better financial insight.

Does it matter?

The short answer is yes, it does.

For starters, the accrual basis of accounting is required by both generally accepted accounting principles (GAAP) and the Financial Accounting Standards Board (FASB). These systems require that income is posted when it’s earned, not received, and expenses posted when they’re incurred, not paid.

This paints a much more accurate picture of the company’s financial position by revealing exactly when capital is earned and spent. For example, it’s essential information for potential investors when they analyze the health and growth of a business. It also makes it possible to compare income and expense statements among comparable organizations, providing important financial benchmarking data to executives, shareholders, and investors alike.

Of course, for AP to carry its weight in this process, it needs to be able to predict not only when invoices will be paid, but to also know when they were created, so they’re accrued to the correct income reporting period.

If an AP automation solution isn’t providing clear insight to that on an ongoing basis, accrued liabilities are likely to be inaccurate, which can certainly affect the prospects of the business when it comes to acquiring investment capital or entering into credit arrangements with key vendors. Meanwhile, providing inaccurate information on financial reporting can create serious compliance problems as well.

More automation isn’t necessarily better automation

Given that respondents with a moderate amount of automation fared almost identically to those with significant automation, it begs the question, “Why aren’t higher-end automation solutions making access to this business-critical information easier?”

It’s hardly a stretch to conclude that not all AP automation software is created equal. Nor is all of it readily configurable to produce the kind of transparency needed by its users.

The fact is, AP doesn’t exist in a vacuum. It’s an integral part of a healthy business and is essential information for finance departments to be able to do their jobs properly.

Hyland and IOFM created the AP Control Panel to help organizations gauge their current insight into working capital and improve control over invoice processing operations. To learn more and check out the latest survey findings, visit The AP Control Panel.

About the Author

Learn more about AP automation and the industry-leading content services platform we build our solutions on.

Blog post originally appeared on https://blog.hyland.com/. Published 07/30/2019 | Updated 08/06/2019